Have you ever wondered why some people seem stuck in an endless cycle of living paycheck to paycheck, while others build wealth almost effortlessly? I’ll tell you something interesting – it might have less to do with your income and more to do with the words coming out of your mouth. Today, I’m going to share common phrases that could be secretly sabotaging your financial future.

You know, as someone who’s spent years studying wealth creation and helping others achieve financial independence, I’ve noticed something fascinating: our mindset, particularly the words we use daily, plays a crucial role in our financial success. The phrases we repeat become our reality, and unfortunately, many of us are programming ourselves for financial failure without even realizing it.

The Power of Words in Financial Success

Let’s get real for a moment. The words you speak aren’t just empty sounds – they’re powerful tools that shape your beliefs, actions, and ultimately, your financial destiny. When you repeatedly tell yourself certain phrases, they become deeply embedded in your subconscious mind, creating a self-fulfilling prophecy.

Let’s break down these wealth-killing phrases one by one, and I’ll show you why they’re so dangerous.

“I’ll Never Be Rich”

This is perhaps the most destructive phrase I hear people say. Every time you utter these words, you’re essentially telling your brain to stop looking for opportunities. I used to say this myself, back when I was struggling with my finances.

Think about it – if you’ve already decided you’ll never be rich, why would you:

- Learn about investing

- Start a side hustle

- Look for better job opportunities

- Save money consistently

The truth is, wealth isn’t just about luck or inheritance. It’s about making conscious decisions and taking consistent action. Instead of saying “I’ll never be rich,” try saying “I’m learning how to build wealth every day.”

“Money Doesn’t Buy Happiness”

Look, I get it. This phrase sounds noble and wise. And yes, money alone doesn’t guarantee happiness. But let me be honest with you – lack of money can definitely buy you a lot of stress, anxiety, and limitations.

What money actually buys you is:

- Freedom of choice

- Better healthcare options

- Educational opportunities

- Time with loved ones

- Peace of mind

Instead of using this phrase as an excuse to avoid financial responsibility, try saying “Money is a tool that can help me create a better life.”

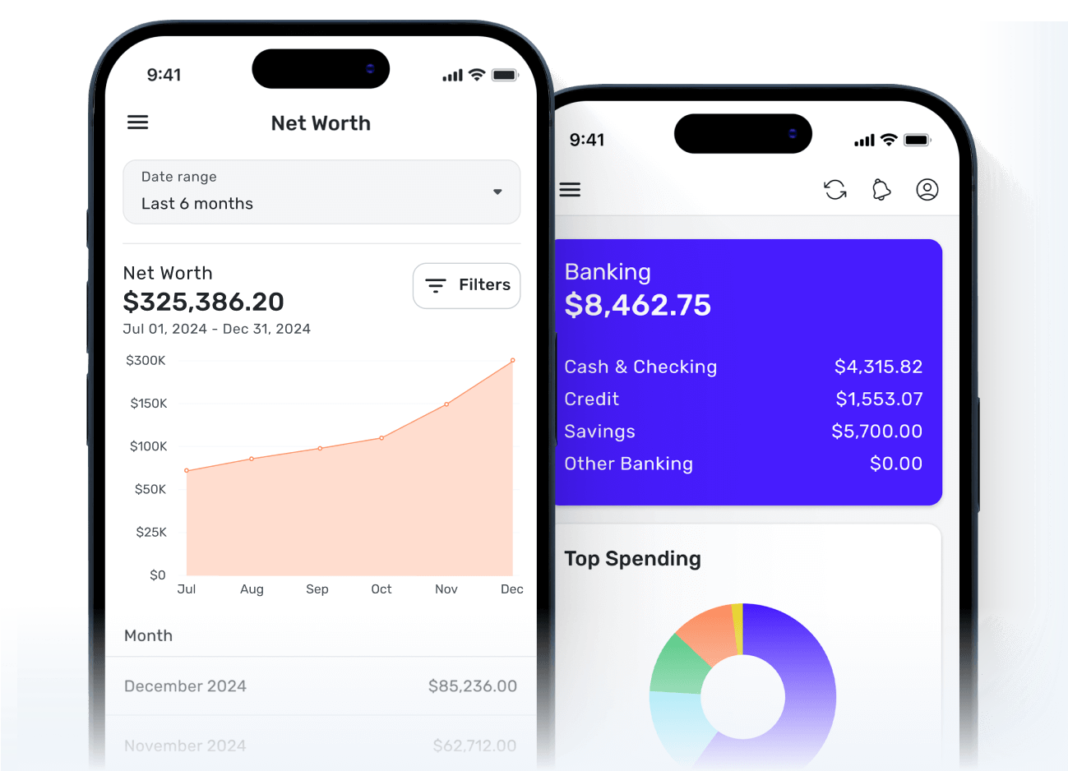

“Investing Is Too Risky”

I hear this one all the time, especially from younger viewers. Yes, investing carries risks, but you know what’s actually riskier? Not investing at all. Thanks to inflation, your money is losing value sitting in a regular savings account.

The real risk comes from:

- Not understanding what you’re investing in

- Making emotional decisions

- Trying to get rich quick

- Not diversifying your portfolio

Remember, the S&P 500 has historically returned about 10% annually on average. That’s why I always say, “I invest wisely to build long-term wealth.”

“I Deserve This Purchase”

We’ve all been there. After a tough week at work, you see something you want and think, “I deserve this.” While self-care is important, this phrase often leads to emotional spending that can wreck your financial goals.

Instead of immediate gratification, try asking yourself:

- Will this purchase still matter in 30 days?

- Does this align with my financial goals?

- Am I buying this from an emotional place?

- Could this money be better invested?

“It’s Too Late to Start Saving”

This is absolutely false, and I need you to eliminate this phrase from your vocabulary right now. The best time to start was yesterday, the second-best time is today. Whether you’re 25 or 55, you can always take steps toward financial improvement.

Remember Colonel Sanders didn’t start Kentucky Fried Chicken until he was 65! It’s never too late to:

- Start an emergency fund

- Begin investing

- Learn about personal finance

- Create additional income streams

Breaking Free From Financial Limitations

Now that we’ve identified these wealth-killing phrases, let’s talk about how to break free from them. Here’s your action plan:

- Practice awareness: Notice when these phrases pop up in your thoughts or conversation

- Replace them with empowering alternatives

- Take immediate action to contradict limiting beliefs

- Surround yourself with financially successful people

- Invest in your financial education

Remember, your new vocabulary should include phrases like:

- “I’m learning to build wealth”

- “I make smart financial decisions”

- “I invest in my future”

- “I’m responsible with money”

The journey to financial freedom starts with the stories we tell ourselves about money. By eliminating these 10 wealth-killing phrases from your vocabulary, you’re already taking a huge step toward better financial habits and a wealthier future.

Remember, your words become your thoughts, your thoughts become your beliefs, and your beliefs become your reality. Choose them wisely.