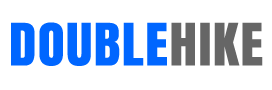

Managing your money wisely is the key to financial success. The right budgeting software can make all the difference in improving your savings and reducing debt. By pinpointing every expense, even those sneaky small costs that tend to slip under the radar, you can regain control of your finances and set the stage for long-term wealth.

A powerful budgeting tool not only tracks spending but also promotes smart habits, like reducing debt and freeing up funds for investment opportunities. Although it doesn’t replace comprehensive tax or accounting software, it plays a crucial role in identifying those pesky, small expenses that can accumulate over time. Let’s dive into today’s best budgeting software, each designed to elevate the way you manage your money.

1. You Need a Budget (YNAB)

YNAB (You Need A Budget) transforms the budgeting process with its fresh approach, making it particularly appealing to the millennial crowd. By linking your accounts, YNAB identifies your total budget amount and guides you in assigning funds to categories like rent, utilities, medical expenses, and debt repayments. A significant goal here is to ensure that every dollar you earn has a definite purpose.

This app takes it a notch higher with features like Age of Money, reflecting how wisely you’re managing finances, and the ability to import transactions directly, including from credit cards. For those new to YNAB, they offer a curious34-day free trial, with subscription options (monthly or yearly) thereafter.

2. Quicken

Although emphasizing mobile solutions, Quicken stands out as a downloadable software supporting both Windows and Macintosh platforms. A stalwart in the financial software field, Quicken eliminates manual entry by downloading all your transactions. Advanced features include data export to Excel, Quicken Bill Pay, custom invoice creation, and secure online backups via Dropbox.

Depending on your needs for features—from customized budgets and priority support to online bill payment—Quicken offers various pricing tiers. The interface is intuitively divided into areas like Spending, Bills, and Income, making it user-friendly and personalized.

3. Moneydance

For fans of desktop budgeting, Moneydance is a compelling choice, especially among Mac users. Yet, it’s equally impressive on Windows and Linux. Seamlessly connecting with U.S. bank accounts, credit cards, and investments, it offers a consistent price across all platforms.

After exploring its demo edition, you’ll know if the full version with a modest fee meets your needs. The software is lightning-fast, user-friendly, and also available in mobile editions for iOS and Android.

4. Pocketguard

Feeling anxious about overspending? Pocketguard is your answer. It’s available on Mac OS and Android, with a desktop version too. Designed for convenience, it centralizes your finances, providing a quick snapshot of your financial health through features like In My Pocket.

With a robust free version, Pocketguard offers an optional upgrade to Pocketguard Plus, which includes additional features like spending limits and savings goals. The clarity it offers into your monetary affairs is invaluable.

5. CountAbout

CountAbout is a versatile budgeting software that excels in importing data from well-known tools like Quicken and Mint. It connects to a vast network of financial institutions, offering customized categories, multi-factor login protection, and comprehensive budgeting modules.

Available as a web-based interface for PC and mobile apps for iOS and Android, CountAbout comes in Basic (manual entries required) and Premium versions (automatic transaction downloads). Its clean interface is a boon for ease of use and customization.

6. Mint

From the creators of TurboTax and Quickbooks, Mint simplifies expense and balance tracking by connecting all your financial accounts. It offers financial analysis and even provides potentially money-saving offers. With multi-factor security and the ability to track your credit score, Mint is a respectable choice.

Best of all, Mint is free, with the company generating revenue through affiliate offers. This user-friendly tool provides the flexibility to connect or disconnect accounts quickly and keeps your data secure with256-bit encryption.

How to Choose Your Ideal Budgeting Software

Selecting the right budgeting tool involves considering how complex or straightforward your financial situation is. If your finances are uncomplicated, opt for a simple solution. When in doubt, take advantage of trial periods to assess which software fits your lifestyle best. The goal? Keep it simple, yet effective. Unleash your financial potential today with one of these fantastic options!