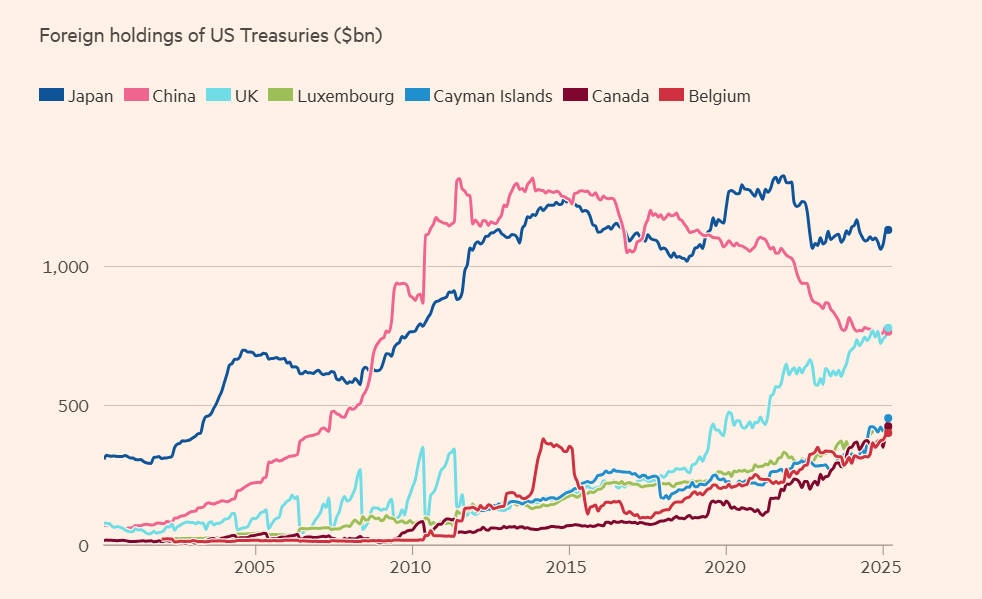

For the first time since October 2000, China’s recorded holdings of U.S. Treasuries have slipped below those of the United Kingdom—a significant development highlighting Beijing’s ongoing strategy to diversify its foreign reserves away from American assets.

As of the end of March, the value of U.S. Treasuries held by Chinese investors dropped to $765 billion, down from $784 billion the previous month, according to U.S. Treasury data. In contrast, UK-based investors increased their holdings by nearly $30 billion, reaching $779 billion. This shift makes the UK the second-largest foreign holder of U.S. Treasuries, behind Japan.

The move underscores a long-term trend in which China has been gradually reducing its direct exposure to U.S. government debt. “China has been selling slowly but steadily; this is a warning to the U.S.,” warned Alicia García-Herrero, chief economist for Asia-Pacific at Natixis. “This has been brewing for years. The U.S. should have addressed it long ago.”

The latest figures come amid heightened concern over the United States’ fiscal health. Ratings agency Moody’s recently followed Fitch and S&P in downgrading the U.S. from its top-tier AAA credit rating, citing soaring debt levels and fiscal imbalances.

China’s pullback from U.S. Treasuries is part of a broader strategy to diversify its reserve portfolio, which peaked at over $1.3 trillion in 2011. The country has been redirecting some of its reserves into U.S. agency bonds and gold. While part of the drop in reported holdings may be attributed to fluctuations in market value, analysts also suspect that Beijing is increasingly using third-party custodians like Euroclear in Belgium and Clearstream in Luxembourg. These entities can obscure the actual size of China’s U.S. asset exposure. In March, Luxembourg’s holdings remained flat, while Belgium’s rose by $7.4 billion.

Historically, China’s massive accumulation of Treasuries stemmed from its persistent trade surplus with the U.S., a trend former President Donald Trump attempted to curtail during his administration. Yet, the implications of China’s gradual exit from Treasuries are being felt in Washington. Officials have expressed growing concern that foreign divestment could raise yields and drive up the cost of refinancing U.S. debt.

Of particular note, the proportion of China’s holdings in short-term Treasury bills—highly liquid instruments that are easiest to offload during financial stress—has risen to its highest level since 2009. This points to a more cautious and flexible approach in China’s investment strategy.

“There is no doubt that China has shortened the maturity of its U.S. portfolio,” said Brad Setser, a senior fellow at the Council on Foreign Relations and a former U.S. Treasury official.

The UK’s rise in reported Treasury holdings, however, does not reflect an increase in its own central bank reserves. Instead, London’s role as a major international financial hub plays a key part. Many of the recorded holdings in the UK are managed by global financial institutions such as insurers, banks, and custodians. Additionally, some hedge funds are known to engage in complex trading strategies involving Treasuries—particularly so-called “basis trades,” where securities are bought and hedged against futures or swaps.

According to Setser, the growing UK figures “likely reflect an increase in Treasuries held by global banks, the availability of custodial services in London, and possibly hedge fund activity.”

It’s also worth noting that the data only captures developments through March and does not include any potential adjustments China may have made in response to the escalation of trade tensions in recent weeks, notably following Trump’s declaration of “liberation day” in his trade agenda.

“There’s a chance China has already shifted its reserve management strategy significantly in the past six weeks,” Setser added. “But we won’t see the full picture until future data is released.”