In today’s global marketplace, workers are always looking for new ways to make money. Workers are looking beyond the typical nine to five job to find new ways to generate income. Instead of a paycheck from the boss at the end of the week, people are working to create multiple sources of income. These passive income investments create income with little upkeep required. Those serious about building wealth should consider passive income streams as part of a personal finance plan.

What is passive income? As the name suggests, passive income is income earned with little effort or maintenance required. Creating passive income streams, however, is not as easy as you might think. Many passive income streams require money, time, and work to start.

The end goal should be a steady stream of income that requires minimal maintenance. The idea is to put your money to work for you instead of the other way around. In addition to building wealth, passive income can work as a security net during a career change. Other benefits include the chance to pursue new careers, to retire early, and to give back to those in need.

Are you looking for a way to save money for early retirement? Do you want the ability to quit your job or work from anywhere? Do you simply want the freedom that comes from building wealth? For those who want to create passive income, the following list may help you get started.

Best Passive Income Investments Ideas

Let’s take a look at the best passive income investments.

1. Real Estate

One popular way to build passive income is real estate. Real estate can provide a steady flow of income and large investment returns.

Managing a property is not as easy as many people believe. Many times, real estate investments require a great deal of time and effort to get off the ground.

Real Estate investments often require a large upfront outlay of cash. Investors must choose between using their own money or borrowing money for the purchase. This can be a problem for those who do not have money to purchase property or who are unable to borrow funds for the purchase.

Once established, real estate investments require at least some work to maintain. Owners can avoid the day to day work of managing property by hiring a property management company. These companies manage the day to day work of the property, but they also eat into profits.

Real estate investing income

If you already own a home or piece of property, there are other ways you can earn income by putting it to use. More and more tourists are seeking out private homes that may provide a more local or authentic experience.

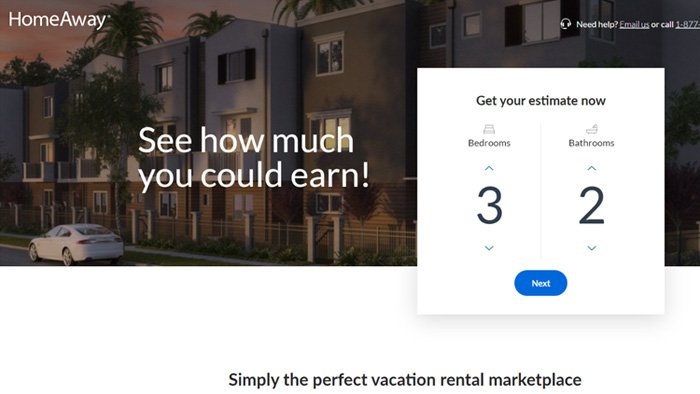

Companies like AirBnB and HomeAway connect travelers to property owners. These sites allow travelers to rent private rooms, apartments or homes directly from a property owner. Do you have an unused room or apartment? Is it in a location that a tourist may want to stay? Transform these spaces into income producing rentals.

Perhaps you don’t own a property. Or maybe you don’t want to deal with the hassles of property ownership. If that is the case, you may want to consider investing in a Real Estate Investment Trust (REIT).

A REIT is a company that owns and manages property. Often times, REITs own multiple properties of one type or for use in one industry. Common industries include multi-family residential developments, industrial complexes, warehouses, and timber lands.

Income from the property is paid to REIT investors in the form of dividends. Many REITs are publicly traded. Shares can be easily bought and sold. Investors do not control property held by the REIT, but they are able to enjoy cash flow without the personal risk of individual property ownership.

2. Dividend Investments

Buying stocks with a track-record of paying dividends is an easy way to create a passive income stream. In fact, it is one of the easiest ways. Some companies pay shareholders a cash dividend on certain date.

All investors who hold shares on that date are paid the cash dividend. While the process itself is easy, dividend investing does not come without risk. Buying any stock requires an outlay of capital.

Corporate stock prices can change quickly based on a wide variety of market factors. So, while you may receive quarterly cash dividends as a shareholder, there is no guarantee the stock will maintain its value.

Before purchasing shares in company, be sure to do your research. You may want talk to a professional who can help you make the right choice for your investment. Not all companies pay dividends to shareholders.

3. Peer to Peer Lending

Peer to Peer Lending is another great passive income investing source. Another good thing about P2P lending is a lot less work needed compared to other passive income source. There are many reputable peer to peer lending companies out there like Funding Circle, Upstart, and Prosper Marketplace.

For more read: How they earn over 10% passive income with peer to peer lending lending.

4. Get Creative

Do you have a creative streak? Do you think that you could turn creations into cash? Why not give it a try? With the proliferation of the internet, people around the world can sell their creations all across the globe. Are you a writer? Self-publish and sell your stories. Are you an expert on a topic or industry? Create and sell a guidebook or instruction manual. Can you effectively teach someone how to do something? Create an online course that people can purchase and take at their convenience.

Do you have an internet connection and passion that you want to share with the world? Start a blog. Many bloggers develop fanbases who purchase products through their blog on which the bloggers get commissions. While these creative offerings may take time and effort to initially create, once the product has been created it can continue to sell for many years with minimal effort and follow-up.

5. Simple Financial Products

Most banks offer products knows as Certificates of Deposit (CDs). CDs allow you to invest money for a specified time frame with a guaranteed rate of return. Most times, the bank will guarantee amount of the investment. This makes CDs an attractive investment option for those people who are looking for passive income with little risk.

When looking for ways to generate passive income, many people overlook options that may be right in front of them. You may be eligible to receive passive income from your employer. Many businesses offer employee retirement plans that will match employee contributions.

For example, if you invest $2,000 in your retirement account in a given year, your employer may match that contribution by investing an additional $2,000.

This is a simple way to earn passive income on an investment for your retirement that you may be already making. If you are currently working, be sure you understand your retirement fund options.

Conclusion

There are hundreds of ways to create passive income streams. Your ability to create passive income is only limited by your creativity, determination, and hard work. With the opportunities afforded by technology and the ease of accessibility to the global marketplace, anyone can develop long term passive income investments.

As you search for ways to develop your passive income streams, keep an eye out for things that appear to be too good to be true. If something seems is too good to be true, it usually is. Get rich quick schemes and investments promising unrealistic returns trick some investors into making poor decisions.

Passive income does not mean easy income. Not at first at least. While the goal of passive income is to make money without much work, investors should be prepared to invest money, time, and effort at the start. Whether your goal is to retire early, quit your job, pursue your passion or pad your bank account, passive income creation can help you achieve it.